A Historic Leap in India’s Renewable Energy Trajectory

India’s renewable energy sector has reached a pivotal milestone. According to the Ministry of New and Renewable Energy (MNRE), the country added a record-breaking 29.52 GW of renewable capacity in FY 2024–25, a historic achievement that reflects not only national ambition but the operational maturity of the industry.

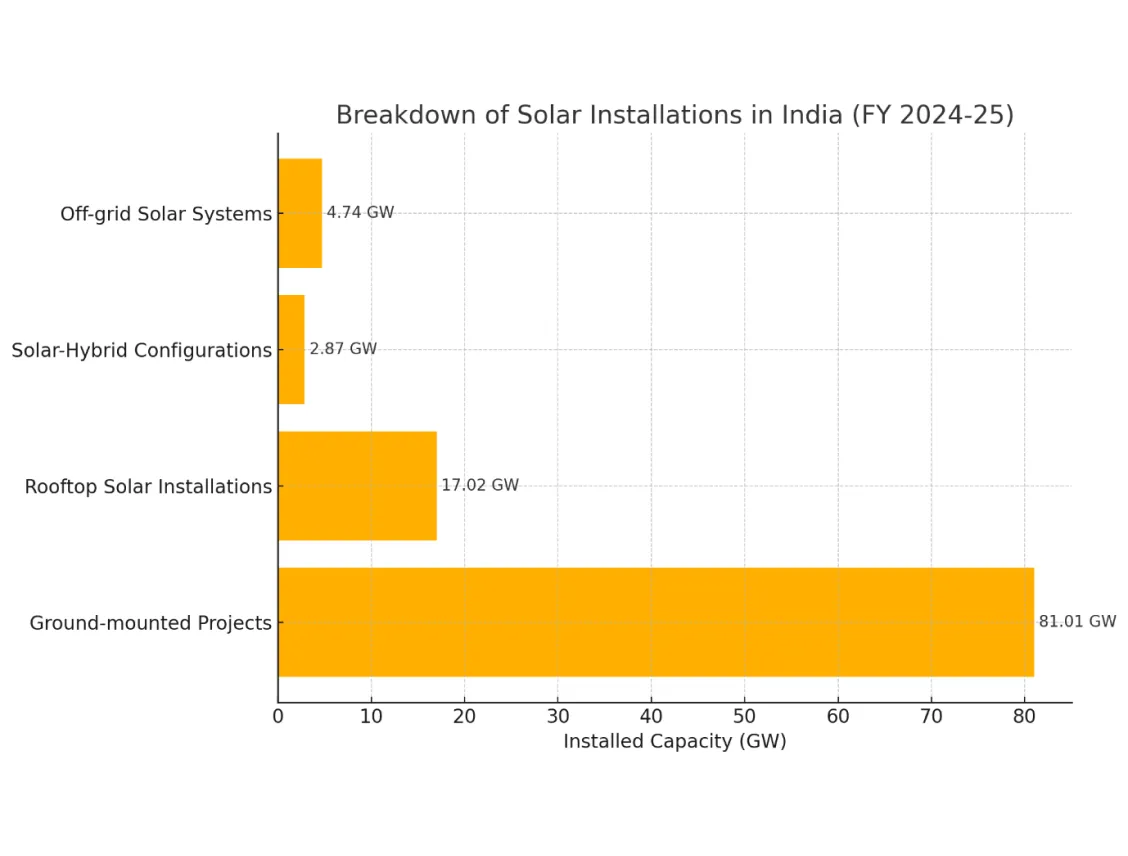

This addition brings the total installed renewable capacity to 220.10 GW, up from 198.75 GW of the previous fiscal. This makes India one of the few countries to witness such sustained, year-on-year growth in clean energy deployment. The trend is deeply encouraging for energy professionals, asset managers, and policymakers seeking alignment with India’s net-zero vision. Among this year’s additions, solar energy remained the dominant contributor, accounting for 23.83 GW, which is more than 80% of total capacity growth:

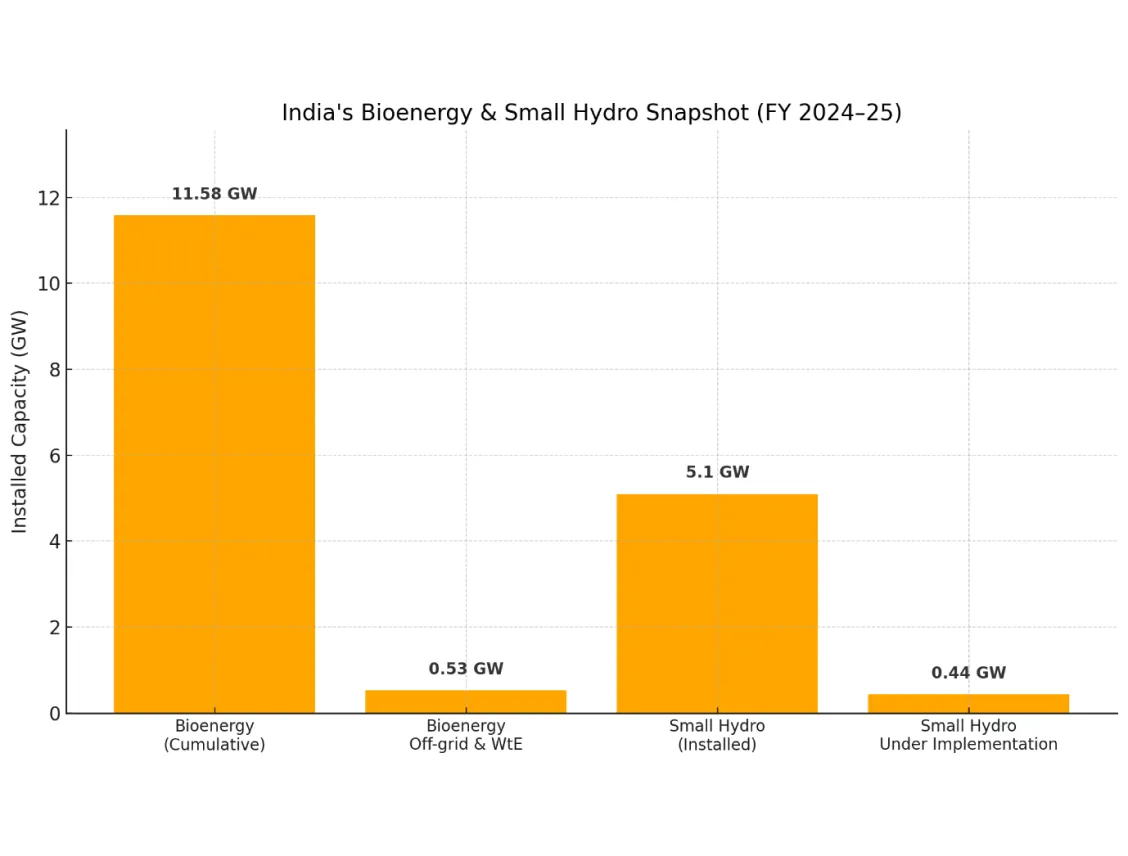

Wind energy followed with a robust 4.15 GW addition, pushing India’s total wind capacity past 50.04 GW. This signals renewed momentum in wind project development after years of plateaued growth. Other key contributors included:

The data reflects more than volume—it reveals sectoral diversification and increasing spatial reach, including installations across resource-rich and underutilized zones.

What’s Driving the Acceleration?

This exceptional performance did not occur in a vacuum. A confluence of regulatory foresight, private capital flow, and technological readiness fuelled this year’s momentum.

- Regulatory Clarity and Forward-Looking Policy Instruments

The rapid rollout of tenders under SECI and state agencies provided developers with predictable market opportunities. Schemes like PM-KUSUM, the Rooftop Solar Phase-II Programme, and Renewable Energy Development for Urban Local Bodies catalysed deployment across user segments.

- Financial Appetite & Private Sector Maturity

Private sector players continued to scale investments, supported by lower cost of capital and increased M&A activity. Institutional investors showed strong interest in solar-wind hybrids and round-the-clock (RTC) procurement models, underpinned by assured returns and long-term PPAs.

- Technology and Cost Efficiency

Average capital costs declined due to improvements in module efficiency and BOS optimization. At the same time, large developers increasingly adopted SCADA, remote diagnostics, and AI tools to manage assets more efficiently bringing long-term operational certainty.

- Grid Infrastructure Expansion

Power Grid Corporation’s expansion of transmission corridors and the launch of GEC-II enabled greater RE absorption. This is especially critical for resource-rich states such as Rajasthan, Gujarat, and Tamil Nadu, which are emerging as national supply hubs.

Implications for Energy Professionals and Asset Managers

For the renewable energy community, these numbers are both validation and a wake-up call. As deployment scales, the emphasis must now shift toward maximizing performance, reliability, and financial yield.

Key Takeaways for Stakeholders include the following:

- Asset Optimization Will Define the Next Phase: As India crosses 220 GW, the industry will be judged not by installed MWs but by the MWhs delivered consistently and predictably. This requires advanced asset performance management systems, predictive analytics, and real-time visibility across portfolios.

- Hybridization is the Way Forward: With 2.87 GW of solar hybrid capacity already contributing to the national mix, hybrid assets (solar + wind + BESS) will become standard. This will demand new skillsets around integration, dispatch optimization, and frequency control.

- O&M Complexity is Rising: With diverse OEMs and asset types across geographies, operations and maintenance (O&M) models will need to move from preventive to predictive frameworks, driven by AI/ML and automated work order management.

- Compliance and ESG Reporting is Non-Negotiable: With increasing investor scrutiny and government mandates, project developers and IPPs must have robust data systems that support real-time compliance reporting, carbon accounting, and ESG disclosures.

- Next-Gen Talent and Tech are Crucial: As RE portfolios expand, so will the demand for digital talent, field engineers, and SCADA/data analysts. The sector must invest in upskilling and cross-functional training to prepare the workforce for the next era of renewables.

Apollo Energy Analytics’ Vision for Performance-Centric Growth

At Apollo Energy Analytics, we believe that India’s journey from 220 GW to 500 GW will hinge not just on deployment but on how intelligently that capacity is managed.

Our platform was purpose-built to support this transformation by focusing on performance, intelligence, and scale. Here’s how:

- Centralized Multi-Asset Monitoring

Apollo unifies monitoring of solar, wind, hybrid, and BESS systems on a single platform. Whether it’s a 100 MW solar farm or a 10 MW hybrid project with co-located storage, Apollo ensures seamless real-time visibility.

- Patented Digital Twin Technology

Apollo’s proprietary digital twin creates dynamic simulations of asset performance under real-world conditions. This allows anomaly detection, yield prediction, and lifecycle optimization, helping stakeholders pre-empt losses rather than react to them.

- Smart CMMS & Workflow Automation

With in-built CMMS capabilities, Apollo simplifies work order generation, technician routing, and inventory control. Asset managers can cut down on downtime and keep operations lean, even at portfolio scale.

- ESG and Regulatory Intelligence

Apollo integrates compliance tools for CEA reporting, carbon intensity metrics, and ESG benchmarks. Investors and IPPs get access to automated, auditable reports tailored to stakeholder needs.

- AI-Driven Decision Support

Through machine learning and historical data analysis, Apollo provides actionable recommendations on inverter performance, cleaning schedules, degradation hotspots, and more, boosting asset productivity and ROI.

- Grid Resilience Lessons from Spain

The 2025 grid event in Spain underscored the vulnerabilities of high renewable penetration without robust controls. Apollo addresses this by simulating grid stress scenarios, predicting curtailments, and enabling real-time responses, ensuring assets remain productive even during grid fluctuations.

From Expansion to Execution

India’s FY 2024-25 growth story is a powerful testament to the sector’s maturity and promise. But going forward, scale alone won’t suffice. The ability to manage this scale through intelligently, efficiently, and sustainably will be the true differentiator.

At Apollo, we’re not just tracking the numbers. We’re building the tools that ensure every GW added translates into long-term value, resilience, and impact.

Because in renewable energy, the future isn’t just installed—it’s optimized.

Interested in learning how Apollo can enhance your renewable asset performance? Reach out to us via contact@apolloenergyanalytics.com or connect through our official LinkedIn page. We’d love to hear from you!

Leave a Reply